Wondering how to optimize your business more effectively?

Lately, there's been a lot of talk about how to fix the budget deficit, the need to make ANAF more efficient, tax hikes, and so on... Yeah, there's definitely a need for major structural reform and way more responsible handling of public money. But at the same time, what's really needed is a mindset shift in the business environment—especially among SMEs—when it comes to voluntary tax compliance.

Right now, Romania has by far the lowest level of bank intermediation in the EU. We're way below the European average because banks struggle to find creditworthy clients who can handle loans above current levels.

And a big part of this comes down to the fact that there's still a significant underground economy going on here (Romania is the EU leader in tax evasion), and many SMEs either don't aim to or don't know how to optimize their financial risk profile to get access to financing.

But is that really the best game plan…?!

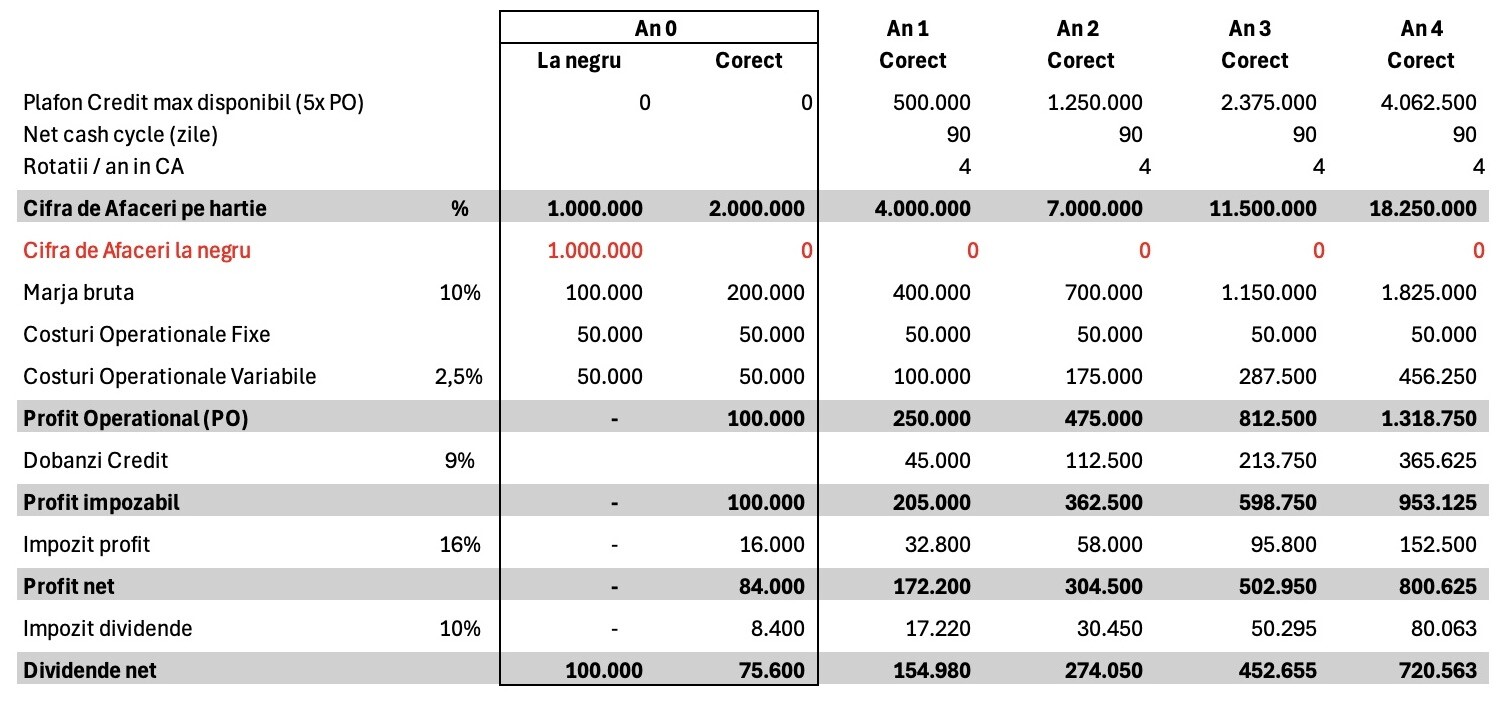

Below, I'm sharing a simple theoretical example to illustrate what it would mean for a small business currently operating partly off the books if it switched to full legal and transparent operations. Doing so would let the business properly reflect its real profitability in its financials and open the door to bank financing.

Let's consider the case of a trading company generating 2 million RON in sales per year, of which 1 million RON is officially recognized as revenue in the financial statements, while the other 1 million RON is run "off the books."

In this scenario, the company would report a net result of 0 RON (zero taxes), and the shareholder would pocket the entire gross margin from the untaxed sales—100,000 RON per year.

But here's the catch: in this setup, the company will NEVER get access to bank financing (it shows a net and operational loss). The business could only possibly grow by the shareholder reinvesting those untaxed profits.

If the company played by the rules though, it would report an operating profit of 100,000 RON, and the shareholder would be left with lower net dividends (after dividend tax) of about 75,600 RON.

BUT!!! The company could unlock a credit line of around 500,000 RON (5x the operating profit), money that, invested back into the business and cycled 4 times a year (assuming a 90-day cash cycle), could double its turnover after the first year! Right after year one, the net dividends to the shareholder in this scenario would be 154,000 RON, compared to the initial 100,000 RON from partly working "off the books"…

By year 4, continuing on the same path, the shareholder would be pulling in 720,000 RON in net dividends per year and running a business with 18 million RON in turnover—compared to the lousy alternative of having worked "off the books" all along.

Not to mention the social impact: during all this time, the company would be paying taxes to the state—money that, if managed responsibly, of course, could be used to build highways, schools, hospitals, reform education to tackle the massive functional illiteracy problem we're already facing, and so on.

The conclusions here are more than relevant, I'd say…

Of course, the economic reality is way more complex than this simplified example, but the bottom line is clear: access to financing can seriously boost the growth of an SME. That said, it requires responsibility, integrity, transparency, and professional financial management of the business.